The 2025 Delaware real estate market is characterised by a rich interplay of economic, demographic, and geographic dynamics. With the distinction of being one of the smallest states in the country, Delaware offers the buyer and investor special incentives in its positioning within the Mid-Atlantic region, beneficial tax regimen, and culturally diverse population within urban, suburban, and oceanfront environments.

This report delivers an educated summary of the state of the present market situation within Delaware’s three counties—New Castle, Kent, and Sussex—considering price trends, inventory levels, buyer demographics, and projections for the future as per the most recent available figures.

Current Market Overview

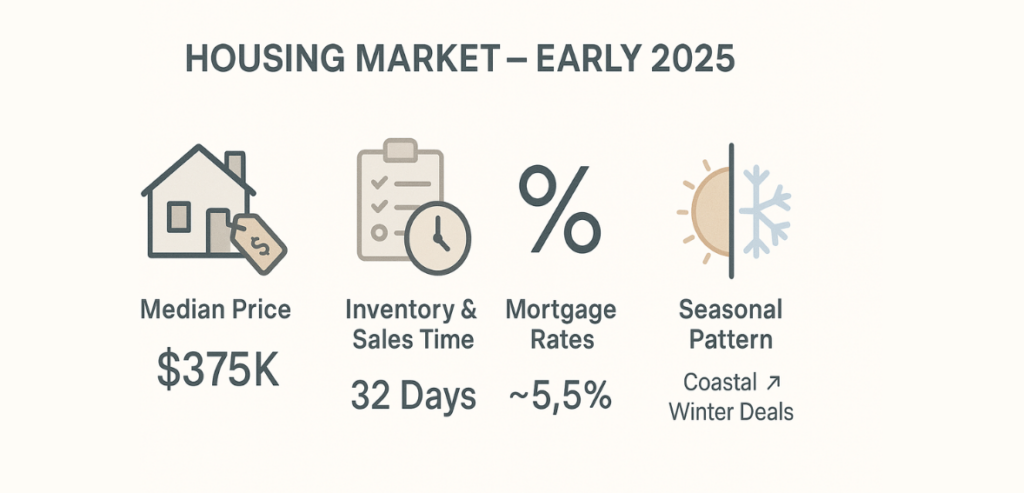

The housing sector in early 2025 post-Delaware is yet to see growth with a stable and balanced stance as per trends. Now, across the state, median home values are running around $375k (a true market). Inventory numbers are in solid condition, which means there are enough active listings to meet the demand of buyers but not enough to create an unsustainable market. Across all states, homes sell in an average of 32 days on the market, which provides buyers time enough to bite or not.

Mortgage rates have settled out in the middle 5% of the range for conventional 30-year fixed mortgage. And in turn buyers and sellers have been able to navigate the real estate deals without feeling vulnerable. The lending platform has all important mortgage instruments for different types of borrowers including traditional mortgage financing all the way down to uncommon products for first-time homebuyers and rural property.

The Delaware Market seasonal demand pattern is still robust, particularly in the coastal suburbs, but with less activity in the spring and summer months. The transaction volume is not only lower during the winter months, albeit more motivated sellers and buyers that provide an operating window for nimble, ready market participants.

Regional Market Analysis

New Castle County

Being the northernmost and most populous of the three counties of Delaware, New Castle County consists of Wilmington, Newark, and some of Delaware’s suburb-type towns. Median home prices for New Castle County are $410,000 as it is relatively near the leading job markets in the region, such as Wilmington’s financial sector and the expansionist technology business.

Downtown Wilmington itself is a classic success tale of downtown renaissance, with many finished mixed-use projects adding density and services to the city core. The projects are especially appealing to young professionals, and downtown Wilmington condos exhibit a high-end market segment price. The riverfront district continues to evolve with more residential holdings supplemented by restaurants, recreational complexes, and cultural institutions.

Christiana-Newark corridor is competitive on account of superior schools, proximity to the University of Delaware, and having primary employers. The corridor further records the county’s lowest average days on the market at 28 days, which marks its continued demand. The area is rendered attractive to various buyer segments by having major medical complexes and increasing retail space.

South New Castle County, encompassing Middletown and the MOT submarket, has high-density residential construction activity. The submarket has about 650 new residential homes, which supply the market inventory. The median sales price of this submarket is $392,000, and new houses sell at 15-20% premiums above similar existing houses. Infrastructure development, such as roadway widening and new public facilities, continues to fuel this growth corridor. These older neighbourhoods in established Greenville, Hockessin, and North Wilmington continue to be among the finest single-family home addresses, with median price values of more than $550,000. These subdivisions have limited potential for new development but provide quaint neighbourhoods with well-established landscaping and building diversity.

Kent County

The core of Delaware state, Kent County, around which the state capital Dover is based, offers an affordable option over its northern and southern counterparts. The median property price in Kent County stands at $315,000. That moderate figure portrays the county with its consistent development and stable market conditions.

Dover’s housing market is enhanced by infrastructure upgrades and economic development programs. Medical facilities and Dover Air Force Base create stable employment bases to underpin housing demand. Dover’s western suburbs show particularly high activity, with new residential neighbourhoods attracting first-time homebuyers and military families. Downtown Dover continues its redevelopment efforts through adaptive reuse developments, transforming historic buildings for residential purposes.

The smaller towns surrounding Dover, including Smyrna, Camden and Harrington, appeal to buyers looking for cheaper alternatives with a fair distance to work centres. Smyrna, located halfway between the Wilmington and Dover metropolitan areas, does well in today’s market because of its location and small-town atmosphere. Its central business district with walkability and community amenities appeals to buyers looking for lifestyle factors in addition to housing value. Rural homes in Kent County with acreage continue to be in strong demand, as they represent a need for space and seclusion among some segments of buyers. These homes usually sell in about 40 days, a little longer than the county average of 35 days, because of their higher prices and more restricted pool of buyers. Farm properties with conservation value or recreational aspects are selling at premium prices in today’s market.

The Kent County communities on the eastern side of Delaware Bay provide distinctive waterfront and water-view homes at lower price levels than those in Sussex County. These communities attract purchasers who want access to natural amenities but not at the price of oceanfront exposure.

Sussex County

Sussex County, the southernmost in Delaware, boasts trendy beach towns and agricultural country. The housing market in this area functions mainly through demand from individuals acquiring second homes and retiring to this location because the median home prices amount to $395,000.

The top real estate locations in Delaware consist of the oceanfront communities that include Rehoboth Beach, Lewes, Bethany Beach and Fenwick Island. Rehoboth Beach holds a position among the foremost performing towns because its median single-family house cost approaches $765,000. The combination of restaurant and cultural facilities and ocean access supports continuous demand for properties despite their elevated costs. Visitors to Lewes Beach find a special combination of a well-preserved historic area adjacent to the park facilities at Cape Henlopen State Park. Residents of this community typically spend $685,000 to own a property, while waterfront residential spaces along with historic district home ownership cost significantly more. The community supporters want to preserve their special character while enabling gradual population growth.

Bethany Beach and Fenwick Island offer quieter, family-focused beach alternatives with high rental potential. Home values, depending on location, range from $610,000 to $750,000 in the beach area. Second-home buyers now have easy options between new luxury townhomes and condominiums as their investment alternatives. The western section of Sussex County stands in opposition to coastal areas mainly because property prices remain lower while market dynamics fluctuate. The buying market in Seaford and Laurel targets customers looking for homes under $275,00. These locales serve as desirable value-for-money neighbourhoods for people careful about housing expenses. Tremendous development takes place along the mid-county pathway stretching between Route 9 and Route 24 as builders construct major planned communities. These offer a middle ground between high coastal access costs and beach proximity. Angola, Long Neck, and Millsboro offer affordability and access.

Market Drivers and Key Trends

Demographic Shifts

Population growth in Delaware continues at a slow pace of roughly 1.2% annually, with much of that growth concentrated in Sussex County (1.8%) and lower southern New Castle County (1.5%). Current migration patterns reflect an influx of retirees and semi-retirees from adjacent higher-cost states, particularly New Jersey, New York, and Pennsylvania. This demographic heavily shapes the coastal Sussex County market and increasingly influences development within central Delaware. Younger buyers, particularly millennials between their 30s and early 40s, are driving activity in New Castle County and the market around Dover. This age group works from within the constraints of prevailing low affordability, prevailing interest rates, and prevailing inventory. Approximately 31% of all statewide transactions in residential real estate are accounted for by first-time homebuyers.

Remote work flexibility influences residential choice, with roughly 28% of Delaware’s workforce having some kind of remote or hybrid arrangement.

Plus, effective January 1, 2025, Delaware minimum wage will rise to $15.00 per hour, marking the final step in a series of annual increases initiated by Senate Bill 15 in 2021 . This adjustment aims to improve the standard of living for low-wage workers and may influence housing affordability across the state.

It fuels demand for homes with a dedicated office space and fuels migration from higher-cost urban centres to Delaware’s comparatively lower-cost communities. High-speed internet access availability is now a determining factor in residential choice, particularly in previously underserved rural communities. The diversity of the population in Delaware continues to increase, influencing neighbourhood preferences and community growth patterns. Schools, cultural amenities, and religious institutions are location factors in selecting a place for residence for many immigrants, creating microclimates of demand within the total marketplace.

Construction and Development

New home construction remains at active levels across the state. There are anticipated to be around 4,800 new homes finished in Delaware during 2025, the division favouring Sussex County (42%) and south New Castle County (35%).

Construction costs exhibit stability as the price of materials increases at an acceptable rate of 3.7%. Labor shortages cause challenges for homebuilders, increasing construction times and adding price premiums to new houses. Increased energy efficiency standards and building code improvements add to construction costs but deliver long-term operating savings to buyers.

New construction composition involves diversified housing types. Traditional single-family developments remain the majority, but townhouse complexes, small-lot single-family developments, and mixed-use developments with residential units gain market share.

This diversity is reflective of affordability and the varying tastes of various groups of buyers.

Infill development increases in established communities, particularly in northern Delaware, as builders pursue opportunities in those locations with built-out infrastructure and proximity to amenities. Such projects typically replace old commercial buildings or repurpose underused properties, adding housing units in areas of demand and reinvigorating communities. Green building methodologies continue to grow in prominence in Delaware’s new building market. Solar readiness, improved insulation packages, water-saving technology, and electric vehicle charging stations increasingly become normal options rather than premium add-ons. Such features become particularly appealing to environmentally conscious consumers as well as to those who value long-term operating costs.

Affordability Considerations

Housing affordability is a top issue in the majority of Delaware communities. The state’s median household income is at a point that creates varying degrees of affordability for various regions.

The affordability formula varies starkly by place. In New Castle County, almost 42% of homes can be purchased at the median house price on conventional terms. This declines to 38% in the beach communities of Sussex County but rises to 57% in Kent County and western Sussex County.

The rental economy operates with median rents that affect the trajectory of the transition from renting to homeownership for most Delawareans. Saving down payments requires diligent planning when rents consume much of one’s monthly income. Rental communities with amenities seek to offer lifestyle-focused alternatives to traditional apartment buildings, attracting residents who prioritize lifestyle considerations alongside housing needs.

There are programs in some cities that address the question of affordability. These include density bonuses to developers who provide affordable units, expedited permitting for qualified projects, and local grant funds for first-time buyers. At the state level, the Delaware State Housing Authority offers down payment assistance and favourable terms for qualified purchasers.

The “missing middle” housing market—e.g., duplexes, triplexes, courtyard apartments, and bungalow courts—is of more interest to developers and planners seeking to address affordability challenges without compromising neighborhood character. This type of housing offers multifamily density benefits without the mass of large apartment buildings.

Investment Outlook

Delaware’s property investment market presents varied opportunities within various market segments and geographic regions. Rental apartment homes near major employers and colleges perform well, with cap rates ranging from 5.3-6.1% for well-maintained properties in desirable locations.

The beachfront Sussex County short-term rental market has strong returns across any regulatory climates and competition in the marketplace. Those properties with consistent summer rental histories can command top dollar, with investors accepting lower cap rates (usually 3.5-4.5%) in exchange for appreciation potential and personal use opportunities. Property management solutions specifically tailored to the vacation rental marketplace allow owners to optimise return on investment while minimising administrative headaches.

Commercial property presents a mixed story, with industrial and warehouse space far outpacing retail and office space. Investment dollars find their way into the I-95 logistics belt in northern Delaware, where vacancy rates are less than 4% and lease rates are strong in favour of good returns. Last-mile distribution facilities and flex spaces are particularly strong in the current market.

The multifamily sector remains active, particularly in northern Delaware and the Dover market. Mid-size apartment properties sell at cap rates ranging from 5.0-5.8%, reflecting investors’ faith in the stability of Delaware’s rental market. Value-add prospects in older properties entice investors who want to drive returns through strategic upgrades and repositioning strategies.

Legislative and Regulatory Factors

Below are a few legislative and regulatory frameworks that affect the 2025 Delaware real estate market. Court orders require redetermination of New Castle County property taxation assessments. The process will promote more fair taxation at current market values. Regulations and coastal zone regulations environmental issues climate resilience planning Coastal zone include flood-prone areas New developments are now subject to stricter regulations in these locations, which affects the development cost and insurance cost in their area, especially eastern Sussex County. Construction design and cost are impacted by elevation standards and stormwater management necessities.

Many local governments in the state coordinate through their respective zoning laws that are focused on the demand for houses. The less substantive changes mostly pertain to making the identified projects denser, mixed land use and providing more weight in locating permitted development projects against community desires. The rule-based system enables not only the adoption of smart growth principles but also a solution to the conservation vs. land use quality trade-off. Policies related mainly to water quality buffering dictate development trends, especially in sensitive locations. Impervious cover limits and buffering/conditioning whereby the extent of impacts is quantified in project design and density estimates. These are more significant for large-scale residential developments and commercial businesses.

Forecast and Outlook

The Delaware housing market outlook for 2025 is neutral to mild price growth on a statewide basis (values will rise about 3-4% over the next 12 months). It hinges on interest rates roughly staying put and local and national economic growth holding. There will be area-to-area differences, but coastal Sussex will very likely have the biggest price increases (4-5%) because of availability-suppressed demand and historical out-of-state buying. Kent County will take most of the form of all-around conditions with 2.5-3.5% appreciation and the beginning stages of inventory supply growth.

Construction may remain very steady at these levels, with around 5,000 units entering the market statewide by next year. consumer supply moderates price appreciation and introduces more choice in towns at different price ranges. The main market risks are possible interest rate surprise that would change the demands of buyers overall and economy that could change consumer confidence. But an expansive economy and location between large Northeast metropolitan centers does offer a certain amount of protection for market swings.

Conclusion

The Delaware real estate market in 2025 is a study in contrasts—varying from upscale coastal resorts in Sussex County to low-price small towns of Kent County. It encompasses the urban vitality of Wilmington as well as the embryonic growth corridors of southern New Castle County. The marketplace presents appealsing opportunities for several segments of buyers and investment strategies.

The market also has solid underlying demand drivers. Delaware’s attractive tax climate, low cost of living compared with neighbouring states and good quality of life continue to attract both primary residents and second-home owners. For those who are doing business in this market—whether as homebuyers, sellers, or investors—understanding these local differences and underlying trends is essential to making informed decisions. Those who know the local market and have clearly defined goals will be best positioned to achieve their real estate goals in the First State.